AstraQuant

Advantages of AstraQuant quantization system

No conflict of interest: truly considering customers and avoiding sales pressure

Traditional issues:

In traditional financial services, advisors often recommend products or services from which they can earn high commissions. You may feel that these suggestions are not entirely for your best interests, but to promote certain products with sales commissions. This approach often leads to doubts about the credibility of financial advice, especially when these suggestions may not necessarily match your actual needs.

AstraQuant benefits:

The AstraQuant system has no vested interests, and all recommendations and strategies are based solely on your financial goals, risk preferences, and personal circumstances. No matter how volatile the market is, the system's advice is always aimed at maximizing your wealth growth, rather than selling a product or earning commissions. You can make decisions with confidence and avoid any sales induced interference.

Data driven decision-making: Say goodbye to emotional fluctuations and make rational investments

Traditional issues:

In traditional financial management, the advice of advisors is often influenced by emotions and market fluctuations. For example, after a significant drop in the market, the advisor may feel low and suggest that you temporarily exit the market; When the market rebounds, advisors may be overly optimistic in recommending chasing after the rise due to their happiness. This emotion based decision-making can easily lead you to miss the best investment opportunity and increase the unpredictability of investment.

AstraQuant benefits:

The AstraQuant system relies entirely on data and algorithms, and will remain calm and rational regardless of market fluctuations. It analyzes all market data, trends, and your financial goals to provide you with validated, long-term effective investment advice. You no longer need to worry about the impact of emotional fluctuations, but can make calm and rational investment decisions.

24/7 service: respond to market changes at any time and seize every opportunity

Traditional issues:

In traditional financial services, you may encounter situations such as consultant vacations, holidays, or off-duty, which may prevent you from making timely adjustments. For example, when you notice significant market volatility and a sharp drop in investments in your account, but your advisor has already left work and will not receive a response until the next business day, resulting in missing the best adjustment opportunity.

AstraQuant benefits:

The AstraQuant system operates 24/7, monitoring changes in the global market at any time. When the market experiences fluctuations, the system will immediately push adjustment suggestions to ensure that you can respond at any time, whether it is day, night, or holidays, to ensure that you do not miss any key opportunities.

Personalized customization: tailor your exclusive wealth strategy

Traditional issues:

Many traditional wealth management services often adopt standardized template recommendations, ignoring the unique financial goals and life stages of each customer. For example, whether you are a young professional newcomer or a soon to retire investor, advisors often recommend similar financial plans, lacking targeted and personalized planning.

AstraQuant benefits:

The AstraQuant system will automatically generate personalized financial plans based on factors such as age, occupation, financial goals, and risk preferences. Each suggestion is tailored to the specific situation of the client, ensuring that the strategy you receive not only meets current needs but also dynamically adjusts with changes in life stages.

Global accessibility: cross regional investment, flexible selection of global markets

Traditional issues:

In traditional financial services, if you invest in different regions or countries, you may encounter differences in culture, language, or market information. These differences may result in your financial advisor's inability to effectively understand your investment needs on a global scale, or limitations in investment strategies in overseas markets. You may miss out on some global investment opportunities as a result.

AstraQuant benefits:

The AstraQuant system not only supports multilingual interfaces, but also a globally unified logical framework ensures that all customers can easily use the system, no matter where they are. More importantly, AstraQuant can provide you with strategic advice from the global market, whether you want to invest in the US stock market, European market, Asia Pacific region, or anywhere else, the system can tailor corresponding investment plans for you. You are no longer limited by geography and can freely choose global markets for investment without worrying about language or geographical barriers.

Lifetime companionship: The system does not take leave to invest and does not disconnect

Traditional issues:

Traditional financial services are a person to person service model, limited by time, manpower, and energy. Your financial advisor may change jobs, take maternity leave, resign, or even be unreachable after work at critical moments. More realistically, most financial advisors will not accompany you for ten, twenty, or even thirty years. Your financial records are scattered across different stages and platforms. If you change advisors, you will have to recount your life goals, risk preferences, and previous investment experiences. The entire process is fragmented, broken, and disjointed. And those small habits that truly affect your financial results, such as always adding positions at the end of the month and easily redeeming during sharp declines. No one has really helped you record and optimize.

AstraQuant benefits:

AstraQuant will not take leave, will not resign, and does not require you to repeat your life story. It is the digital think tank in your account, continuously recording your investment behavior trajectory 24 hours a day. From the moment you make your first purchase, the system will automatically record your decision preferences, operating modes, success and failure experiences, and continuously optimize the suggestion logic over time. The more you use it, the better it understands you.

For example, when you always redeem and take profits in advance during multiple market turbulence, AstraQuant will recognize this behavior pattern and remind you in similar situations in the future: Have you ever missed 30% of the upward space due to premature exit? Have you considered using a more robust phased reduction strategy? This is not only a suggestion, but also a customized behavior replay and decision coach based on your growth process. AstraQuant is a lifelong companionship system tailored for you. Know you better than a consultant, be more rational than a friend, and know better than yourself what to do next.

Easy operation: One click embedding, easily responding to market fluctuations

Traditional issues:

In the traditional investment process, making a portfolio adjustment is like fighting a battle. You need to first exit the trading interface, open several analysis tools to compare data, and may also need to call or email consultants to confirm before returning to the platform to manually adjust your position. If the market experiences sudden fluctuations, such as unexpected release of inflation data or a sudden drop in a heavily held stock, and you are still in the process of switching back and forth, analyzing, and placing orders, the market opportunity has already slipped away. On the day of the Federal Reserve's temporary interest rate hike in 2023, a large number of retail investors missed the best hedging window due to their delayed response.

AstraQuant benefits:

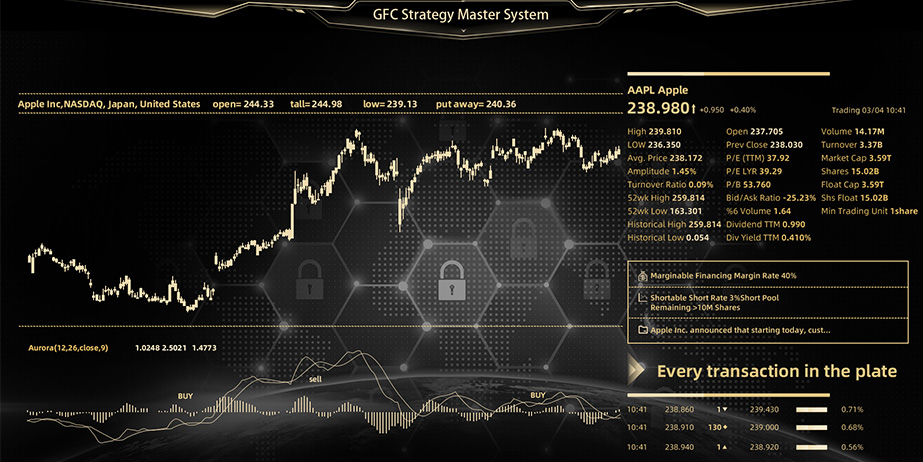

AstraQuant is an intelligent assistance system seamlessly embedded into users' existing trading software, without the need to change platforms, skip screens, or relearn. All strategy recommendations, asset allocation, and risk warnings are directly integrated into your familiar trading interface. When the market suddenly changes, AstraQuant will pop up personalized adjustment suggestions in real time, such as reducing positions in technology stocks and increasing holdings in safe haven gold. You only need to confirm with one click, and the system can complete the execution in milliseconds. Just like when you're driving, the AstraQuant system automatically navigates the passenger seat, applies the brakes, saves time, and avoids losses caused by delayed judgments.

Transparent fees:

Clear fee structure to avoid hidden costs

Traditional issues:

In traditional financial services, fees are often vague and unclear. You may need to pay management fees, transaction fees, consulting fees, etc., but the specific structure and impact of these fees are often not clearly stated. Many times, consultants or companies may not provide you with detailed information about the composition and payment methods of each expense, and some expenses may even be deducted without your knowledge. Even in some cases, service fees may be linked to the products or services sold, and consultants' income may be linked to the sales performance of the investment products they recommend, thereby affecting the independence and objectivity of the advice they provide to you. You often feel like you are paying for unnecessary expenses that affect investment returns.

AstraQuant benefits:

The AstraQuant system adopts a transparent monthly or annual fee charging model, with only one fixed service fee and no complex implicit charges or bundled benefits. You only need to pay a fixed fee to enjoy comprehensive support for all system functions, without worrying about additional fees or conflicts of interest. This means that you have a clear understanding of which service you are paying for and do not need to worry about hidden fees or sales commissions behind the products recommended by consultants. AstraQuant is not affected by any external products or services and always provides optimal investment advice based on your financial needs. AstraQuant gives you absolute control. You can invest with peace of mind.

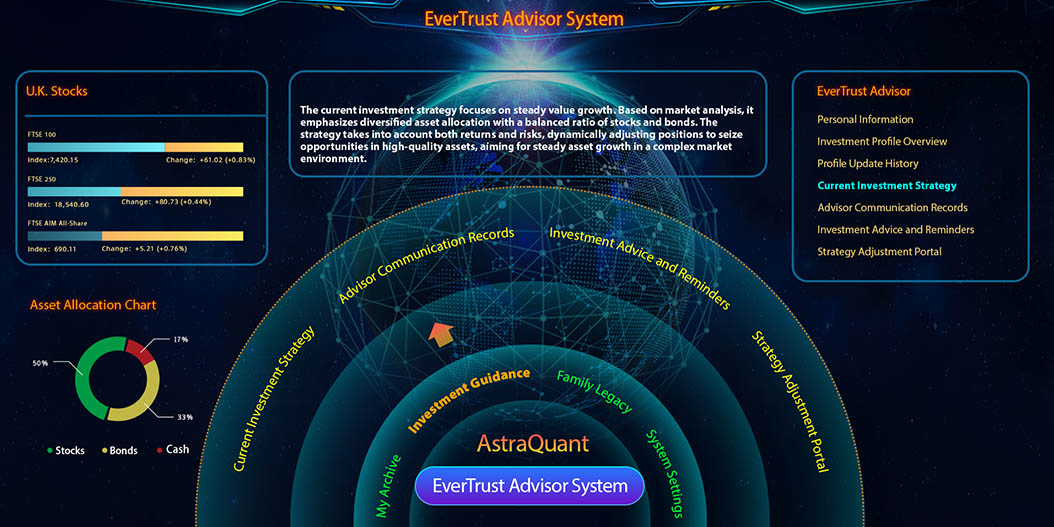

Wealth Inheritance: Recording Investment Wisdom to Ensure Intergenerational Inheritance of Wealth

Traditional issues:

Many people have been managing their finances for many years and have accumulated a lot of experience after stepping into pitfalls, but these wisdom are hidden in your mind, and your family actually has no idea how you make decisions.

Once you temporarily don't have time to manage your account or hope that your family can help manage it, they often can't take over and can only start from scratch, missing key opportunities.

The AstraQuant system records the logic and underlying thinking behind every investment decision, forming a personal wealth trajectory file.

You can share these files with your family to ensure that they not only inherit your wealth, but also learn your investment philosophy and strategy, enabling the smooth inheritance of wealth management.

Decision Transparency: Each suggestion is supported by data, making informed decisions

Traditional issues:

In traditional wealth management, you often only see the results: whether the account has risen or fallen, whether assets have increased or decreased, but the decision-making reasons behind them are always unclear. The advice given by consultants often lacks complete data support or decision-making logic, and you may simply passively accept their recommendations, even feeling at a loss. When the market experiences severe fluctuations, advisors may suggest reducing your position, but you do not know which market analysis or historical data is used to make this judgment. Even if you want to review, it is difficult to find the judgment basis and decision-making logic at that time, and you cannot learn from past investment experience.

AstraQuant benefits:

AstraQuant not only tells you how to do it, but also shows you why you do it. Each suggestion comes with market data, inference logic, and historical backtesting, and tracks your investment behavior like a transparent investment recorder. You can review your performance in similar situations in the past to determine which strategy is most suitable for you.

AstraQuant System

Intelligent Investment Solution

Firex21 Capital, with its AstraQuant quantitative trading system and the financial technology innovation behind it

is driving significant changes in the global investment industry. Through intelligent trading decisions, innovative asset matching

and risk management functions, Firex21 Capital helps investors break through the limitations of the traditional financial system

ushering in a new era of more fair, transparent, and intelligent wealth appreciation.

Firex21 charity

Integrating investment and charity to create a shared future, Firex21 Capital's goal is not only to bring returns to investors, but also to build a bridge connecting wealth and social welfare, allowing financial capital to truly serve the common interests of all humanity.